Introduction

The Nike athletic machine began as a tiny shop and a distributing outfit located in the trunk of a car in 1964. Phil Knight sold $8,000 worth of Tigers* and placed an order for more. After cresting $1 million in sales and riding the wave of the success, Knight devised the Nike name and trademark Swoosh in 1971.

By the late 1970s, Blue Ribbon Sports officially became Nike and went from $10 million to $270 million in sales. The 1980s and 1990s would yield greater and greater profits as Nike began to assume the appearance of athletic juggernaut, rather than the underdog of old. “Advertising Age” named Nike the 1996 Marketer of the Year. That same year Nike’s revenue [was] $6.74 billion. In 2012, its annual revenue was a staggering $24 billion.

* A type of running shoe

Using accounting information

An example

Jason Toews and Dustin Coupal saw a need for a site to help people find the cheapest local gas prices and founded GasBuddy.com in June of 2000. At the time, Toews was working as a computer programmer and Coupal was an eye doctor. The partners nurtured the website over the course of the next decade, persuading drivers to log in and share gas prices – not an ideal situation, of course. Then, in 2009, the partners realized the potential of mobile apps. So the company launched Android and iPhone apps later that year, and they were instantly popular. Today, six million people have downloaded their apps.

These partners learned, early on, that financial institutions require properly prepared balance sheets to justify providing capital for growth, and that income statements are a mechanism for tracking performance over time. Although positive cash flow is one of the most important parts of their business, the partners have to ensure that all reports are prepared in a standardized manner.

Accounting fundamentals, principles, and practices

Introduction

These are impressive numbers for a business that started in the trunk of someone’s car! In fact, the business’s spectacular growth was the result of countless financial decisions made along the way. While many factors have no doubt contributed to Nike’s success, one thing is certain: in order to make these strategic decisions and others, the company’s managers relied on accounting information.

They’re not the only ones. Over the years, shareholders and potential investors have also used Nike’s financial information to make investment decisions.

In short, sound accounting information lets the Nike group and all interested parties know exactly how the business is doing at all times – an essential part of a winning strategy! Large companies and sole proprietorships also rely on accounting information to make business decisions.

What you will learn

After completing this learning activity, you will be able to:

- demonstrate the relationship between generally accepted accounting principles (GAAP) and actual or current accounting practices

Why is accounting important?

Accounting is the process of identifying and recording a business’s economic events and transactions, and communicating them to a variety of interested users in report form. Investors and stakeholders require these financial reports to be highly transparent, relevant, and dependable. If not, this can have catastrophic results for both the investors and the company. Poor accounting can cause a company to go out of business or fall into debt, owing money to banks and investors. In cases where laws are broken, senior managers may have to pay penalties or serve jail time.

So, you might be thinking that accounting is important only to those students who want to become accountants. What about learners who aren’t interested in this career path?

Understanding accounting essentials is crucial for everyone. By studying accounting, you will learn about the world of business, including different types of businesses and how they work.

You may plan to own your own business one day, or invest in one (if you haven’t done so already). The way that you read, interpret, and analyze financial information will give you a valuable set of skills for making sound financial decisions.

By now, you may have realized that accounting knowledge is a powerful tool, and a key ingredient for success. But, how does knowledge give you power? What exactly does accounting focus on? In the next few topics, we will address these, as well as other questions.

What makes accounting powerful?

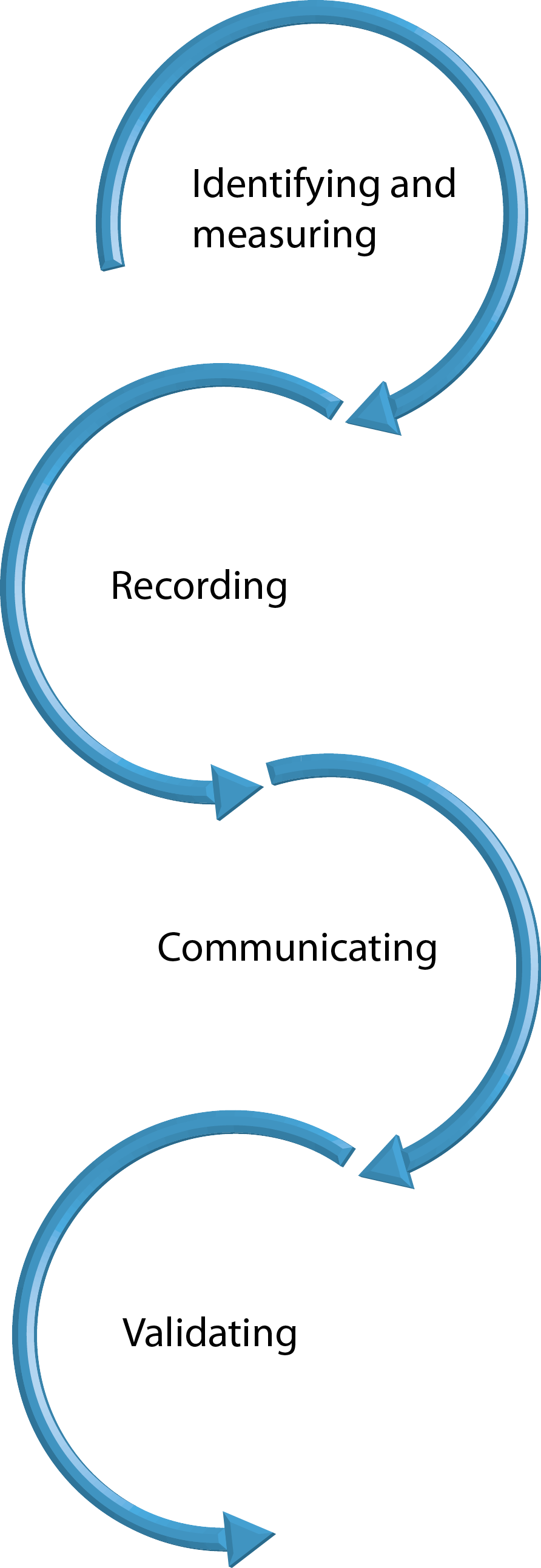

Accounting’s main objectives are identifying and measuring, recording, communicating, and validating. It involves collecting, recording, and reporting an organization’s financial situation to its various decision makers.

Accountants help people to make better financial decisions. They help them to assess prospects, products, and other opportunities. As well as reporting on a business’s performance, accountants also report on what the business owns and owes. Essentially, accounting is a tool that opens our eyes to endless possibilities.

The power of accounting: An example

TD Bank teams up with Starbucks to brew up an innovative customer experience

TD becomes the first major Canadian bank to invite a full-service retailer into a branch. Imagine the convenience of completing your daily banking and ordering your “Double, Tall, Non-Fat Latte” all under the same roof!

How do you think this partnership came about? Both parties used a powerful tool – accounting – to thoroughly analyze all of the information available in order to make their decision. Let’s face it: both of these companies are well known, but they have different customer bases. Therefore, increasing customer exposure to both parties in this way will ensure positive results for both conglomerates involved.

What does accounting focus on?

Accounting affects all parts of our lives: mortgage applications, credit card applications, bank accounts, and car loans, to name a few. These examples, however, only involve the recordkeeping part of the accounting system. Bookkeeping/recordkeeping is the system used to record a company’s financial transactions. Accounting involves the recordkeeping process, but this is just one of its many applications.

Why is good accounting important? What problems can bad accounting cause?

Good accounting provides everyone involved in the business with accurate information about how the business is doing, where it is making money, where it is losing money, and how much it should pay in taxes. Bad accounting can have catastrophic effects for both investors and the company. It can cause a company to go out of business or fall into debt, owing money to banks and investors. In cases where laws are broken, senior managers may have to pay penalties or serve jail time.

How can the study of accounting benefit you, even if you are not interested in an accounting career?

By studying accounting, you will learn how the world of business works. The way that you read, interpret, and analyze financial information will give you a valuable set of skills for making sound financial decisions as a business owner or investor.

Using accounting information

The two main groups/users of accounting information are internal and external users.

Internal users

Internal users use the information gathered to plan, organize, and operate their companies. Individuals such as managers of finance, production, and marketing, as well as human resources personnel, all use accounting to make crucial decisions.

In the daily running of an organization, internal users must answer similar questions. Continue below to explore the kinds of questions they ask.

In order to answer these and many other questions, users require highly detailed and accurate information that is up to date. For example, they need to know information such as cash flow projections for the upcoming year, projected profits, and budgets.

Using accounting information

External users

These individuals are not involved in the daily running of the organization. Examples of external users are shareholders, lenders, directors, customers, suppliers, brokers, and the press. Each of the users mentioned has a special need for the information provided, depending on the decision they need to make.

In order to make certain decisions, specific key questions have to be answered:

Investors

Based on the company’s performance, will I get back what I have invested?

Creditors

Will the company be able to pay its debt?

Understanding accounting ethics, concepts, and principles

Accounting ethics

Ethics are moral principles that govern the way people behave. In business, ethics are generally accepted moral and professional principles used to differentiate right from wrong. Ethics are particularly important within the accounting profession, as well as in other professions dealing with finances. Businesspeople who lack ethics are usually regarded as untrustworthy.

Ethical practices build trust, which promotes loyalty and long-term relations between all parties involved. Good ethical practices enhance the organization’s reputation and success. This is why accounting principles are created, maintained, and followed.

A company’s financial information is communicated using various accounting reports, the most common being financial statements. Accountants prepare these statements using standardized guidelines, to make the information provided in them meaningful. Every profession creates its own standards based on ethics and norms, and accounting is no exception.

Accounting concepts

To use accounting information, we need to thoroughly understand the basic assumptions and principles of accounting in Canada, including the generally accepted accounting principles (GAAP).

Accounting assumptions

In accounting, we treat a business and its owners as two separately identifiable entities. This is sometimes called the "business entity concept." It means that owners' personal transactions are treated separately from those of the business.

The monetary unit assumption has two parts. The first states that only transactions that can be measured in money or currency should be recorded. An example of a transaction that is not recorded on the accounting books is the hiring or firing of employees, even though this can indirectly affect the company's "bottom line."

The second part of monetary assumption states that there will be one currency used for recording all transactions. In this course, it is always the Canadian dollar, unless an example specifies another currency.

This is a basic underlying assumption in accounting. It states that a company or other entity will be able to continue operating for a period that is sufficient to carry out its commitments, obligations, and objectives. In other words, the company will not have to liquidate or be forced out of business in the foreseeable future (that is, for at least 12 months).

Assets should always be recorded at their cost, rather than their current value, for the life of the asset. Accountants can show an amount less than the cost due in order to give a conservative estimate, but they are generally prohibited from showing amounts greater than the cost. Later in this course, you will learn that certain types of investments will be shown at fair value, instead of cost.

The accountant assumes that, in the long run, the Canadian or American dollar will be relatively stable – they will not lose their purchasing power within the country. This assumption allows the accountant to add the cost of a parcel of land purchased in 2013 to the cost of land purchased in 1956.

For example, if a two-acre parcel of land cost the company $20,000 in 1956 and a two-acre parcel adjacent to the original parcel is purchased for a cost of $800,000 in 2013, the accountant will add the $800,000 to the land account and will report the land account’s balance of $820,000 on the company’s balance sheet.

To say that the dollar's purchasing power has not changed significantly from 1956 to 2013 is quite a stretch. However, the assumption is that the dollar's purchasing power has not changed.

Accounting principles

In their work, accountants are required to make evaluations and estimates, state their opinions, and select accounting procedures for representing financial information. They should do so in a way that neither overstates nor understates a business's affairs. The principle of conservatism states that the accounting for a business should be fair and reasonable.

This principle requires accountants to use the same methods and procedures from one fiscal period to the next. This prevents individuals from changing methods of accounting for the sole purpose of manipulating figures on financial statements. If changes are made, they must be fully revealed in the financial statements.

This states that any and all information that affects the full understanding of a company’s financial statements must be included with the financial statements.

This accounting guideline requires that revenues be shown on the income statement in the period within which they are earned, not in the period within which cash is collected. This is part of the accrual basis of accounting (as opposed to the cash basis of accounting).

Expenses must be recorded within the same period that the related revenue was earned. For instance, if a partnership collects revenue upfront from a client for a job that is yet to be completed, the company must match future expenses to this revenue. This principle essentially states that any and all information that affects the full understanding of a company’s financial statements in a given period must be included with the financial statements.

Generally accepted accounting principles (GAAP)

The underlying ideas that make up acceptable accounting practices are called “generally accepted accounting principles (GAAP).” These include broad principles and practices, as well as rules and procedures. GAAP are applied when the accounting information is recorded and reported. It is important to point out, however, that GAAP are not static; they change over time.

For those fiscal years starting on or after January 1, 2011, Canada abandoned Canadian generally accepted accounting principles (GAAP) and adopted international financial reporting standards (IFRS) as the preferred accounting standard. However, companies were allowed to adopt the U.S. GAAP, instead of IFRS. As a result, many small- to medium-sized Canadian firms prepared reports using the U.S. GAAP after Canada had adopted IFRS. The companies that were more likely to choose IFRS were larger, or were in the start-up stage, or had no (or few) U.S. operations. A third option, which is open only to not-for-profit organizations, is to follow the “not-for-profit (NFP) reporting standards.”

Watch This!

Relationship between GAAP and current accounting practices

Access this video, to understand the general difference between the U.S. GAAP and current accounting practices.

The term “generally accepted” means that the GAAP have authoritative support from both U.S. and Canadian banks, companies, and institutes. For example, the Chartered Professional Accountants (CPA) of Canada is responsible for developing accounting principles in Canada. (For more information on the CPA, do an Internet search using the terms “chartered professional accountants” and “CPA.”) CPA has primary responsibility for developing and issuing our GAAP. The Canada Business Corporations Act and the Ontario Securities Commission recognize these principles as the standards to follow for preparing and communicating financial information.

Self Check

Practice what you have learned

To review what you have learned in this learning activity, answer the following questions.

What is the difference between external and internal users of accounting?

How can the study of accounting benefit you, even if you are not interested in an accounting career?

Internal users of accounting are those within a company, such as managers of finance, production, and marketing, as well as human resources personnel. External users include shareholders, potential investors, and creditors.

Ethical practices build trust, which promotes loyalty and long-term relations between all parties involved. Good ethical practices enhance the organization’s reputation and its success. This is why accounting principles are created, maintained, and followed.

Conclusion

In this learning activity, you learned how businesspeople and companies use financial information to help them make investment decisions. You also learned about accounting ethics, concepts, and principles.